Top Guidelines Of Estate Planning Attorney

Top Guidelines Of Estate Planning Attorney

Blog Article

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is Talking AboutExamine This Report on Estate Planning AttorneyThe Definitive Guide to Estate Planning AttorneyEstate Planning Attorney for DummiesEstate Planning Attorney - The Facts

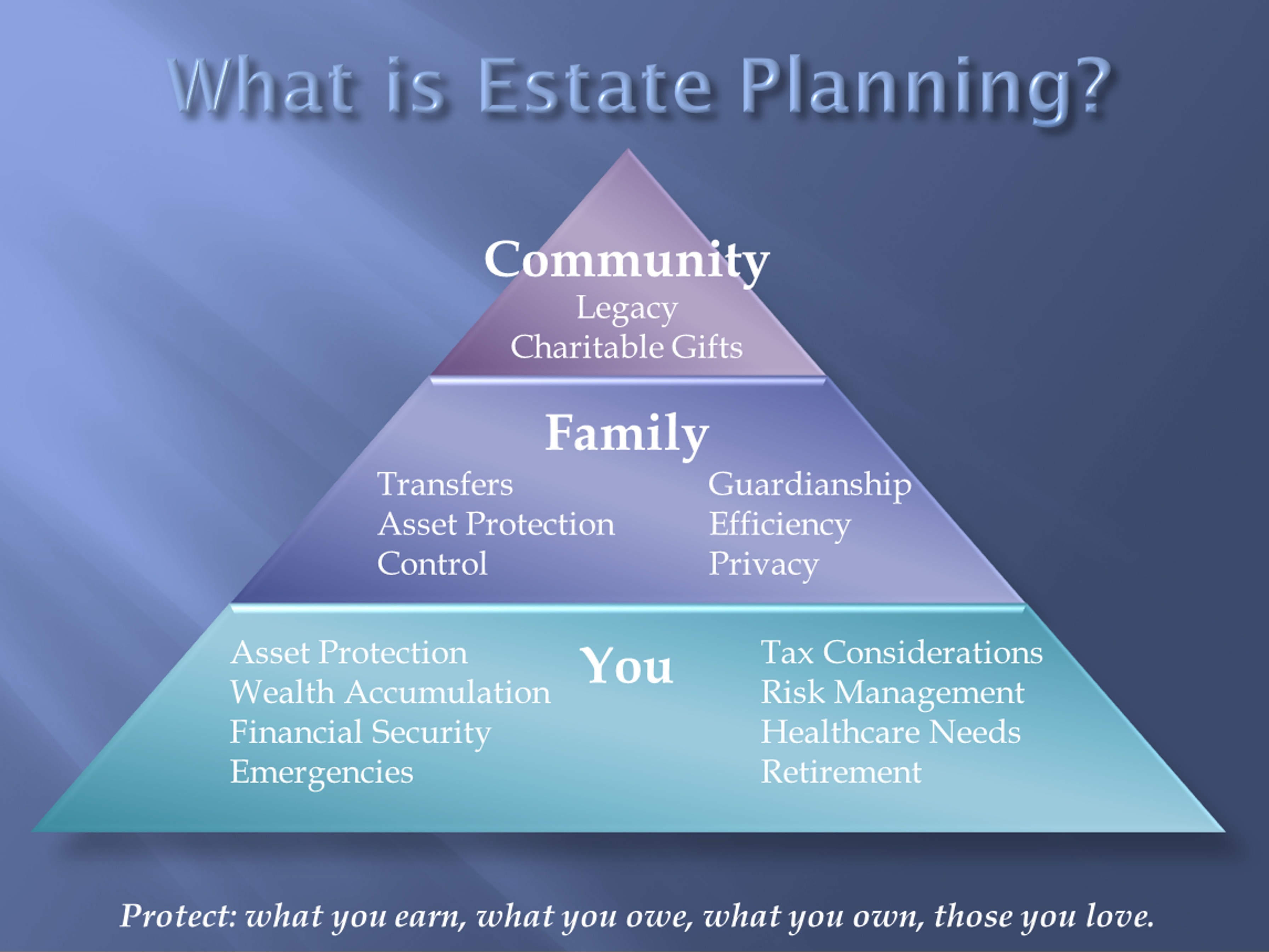

That's our feature, to generate the important, personal family information and economic information that we need so that we can best prepare the estate strategy for the client. Makes great feeling, Richard. A great deal of great things there. Thank you for investing a long time with me today. And we appreciate you being with us and you be well.Your estate consists of all the assets you have at the time of your fatality. These properties could include: SecuritiesReal estateInterest in a businessPersonal propertyCashRetirement plans and IRAsLife insurance survivor benefit You strive and carefully plan to fulfill your long-term financial objectives, such as financing an education and learning, providing for your youngsters and saving for retired life.

When you develop a living trust fund, you should bear in mind to transfer your assets into the count on. Assets that are not in your trust, that do not have beneficiary classifications or are not jointly labelled with one more person might still go through probate. You need to go over the transfer of tax-deferred possessions, such as individual retirement accounts (IRAs), Keoghs or pension, with your attorney or accounting professional.

See This Report about Estate Planning Attorney

Furthermore, probate is generally required when a private passes away without a will (intestate). A trust fund is an estate preparation device that specifies exactly how you would certainly like your possessions to be taken care of and distributed to your beneficiaries. It is a lawful paper that names an individual or establishment to manage the assets put in the depend on.

A living count on is a collection of guidelines describing exactly how you desire your properties to be taken care of and distributed to you and your beneficiaries. Estate Planning Attorney. When you develop a living trust fund, you register your possessions to the count on, and the trust comes to be the proprietor of the possessions, however you preserve total control

As its name indicates, this count on can be changed or revoked at any kind of time throughout your life. A Testamentary Trust is created in a will and is just legitimate after the probate procedure is completed. This count on does not resolve your incapacitation. A Philanthropic Rest Trust fund is a tax-exempt, unalterable depend on that permits a contributor to make a current gift of money or appreciated possessions to a trust while getting an earnings stream from the depend on for his/her life.

Some Known Details About Estate Planning Attorney

The trust fund might supply a current earnings tax obligation deduction, freedom to sell possessions without immediate resources gains awareness, and potential for decreasing or removing estate tax obligations. After an attorney has actually set up your count on, money and/or appreciated assets can be moved right into the depend on. The depend on might name you and your spouse as earnings recipients, which implies you will get revenue for the period of your lives, or for a regard to years.

If you marketed your valued possession outright, you would certainly pay a tax on the resources gain you identified from the sale. If the Philanthropic Rest Trust sells a valued possession, no directory funding gets taxes are owed at that time. As a result, even more money is readily available for reinvestment inside the site trust fund than would be if the property was marketed outright.

These counts on are complex and need to be thoroughly administered to make certain optimal revenue and inheritance tax benefits (Estate Planning Attorney). The Edward Jones Trust Company can take care of the management of possessions, as well as ongoing management and reporting. If you make a decision to act as your own trustee, you take single responsibility for continuous administration of the trust, which is a significant duty

Some Known Questions About Estate Planning Attorney.

Planning for completion of life can be an emotional and stressful procedure, but having an estate strategy in place can reduce several of the unpredictability and stress, laying out guidelines for your treatment in the event of your incapacity and preventing domestic fights upon your passing. Estate Planning Attorney. From powers of lawyer to buy-sell agreements to wills and depends on, there are several tools and several considerations to be taken into account when intending your Florida estate

Contact our Tampa estate preparation, wills and trusts lawyer today for more details. A depend on is a partnership between a settlor, a trustee, and a recipient.

The trustee then manages the properties for the benefit of the beneficiary, based on criteria set out in the trust fund. Depending upon the type of trust fund, a trust fund can be utilized to: Lessen tax obligation; Shield properties from lenders; Handle cash for younger, handicapped, or untrustworthy relative; and Avoid probate.

How Estate Planning Attorney can Save You Time, Stress, and Money.

The individual rep has the obligation to make certain that all recipients obtain tidy title to the assets they acquire. Probate is a complex procedure, with many steps and needs. A Tampa probate attorney can recommend the personal representative of an estate on exactly how to continue in the probate process and can aid to retitle properties and make sure tidy title.

Report this page